Working in the Technology Industry in China

My journey at Kuaishou and My thoughts on the rise of short-form video products

Dear readers, I hope this message finds you all in good spirits! I apologize for my recent absence as I have been travelling on the roads.

Today’s post is an excerpt from my recent sharing at an investor community in Hong Kong, where I discussed my thoughts on short form video (“SFV”) and shared my experiences in the technology industry in China.

For readers who we haven't had the chance to meet yet, I previously worked as a product manager for Kuaishou Technology (1024.HK), a leading technology company in the field of SFV and live streaming in China. During my tenure, I focused on new business incubation, internationalization of short video product, and live-streaming e-commerce. In this post, I will touch on three topics:

Introduction to Kuaishou

What it's like to work at tech industry in China

Why SFV becomes a success and works well for a large-scale user base

It's important to note that this article does not serve as an investment analysis of Kuaishou. Instead, it utilizes Kuaishou as a starting point to provide a more comprehensive understanding of the individuals working in the tech sector, the working environment, and my perspective on the content format of SFV and the products my colleagues and I have built.

Introduction to Kuaishou

Regarding the products, Kuaishou's main offerings are SFV and live streaming. In the bottom left corner, there is an example of a SFV from Jackie Chan's official account on Kuaishou. As you can see, SFVs typically span 10 to 15 seconds. This particular video employs two common techniques used in SFV production to enhance the viewing experience: 1) costume changing, and 2) beat-matching (aligning the timing of costume changes perfectly with the rhythm of the music). This is just one example to give you some touchable feeling, as the platform features various types of SFVs, ranging from funny, sports, foodie, pets, news, vlogs, and more.

The two examples in the middle showcase live streaming scenarios. One is Xiaomi's official live streaming room, where you can directly purchase the featured product by clicking on the product card in the bottom right corner. The other example is a jewelry and gemstone live stream, which is a popular category of e-commerce live streaming on Kuaishou. Jewelry and gemstones are better showcased through live streaming versus traditional shelf ecommerce, and trust is particularly crucial for such high-value items. On platforms like Kuaishou, you can establish trust with sellers by following their accounts over an extended period and gain better insights into other consumers' evaluations through bullet comments as well as product reviews.

The example on the far right is a case of a splash screen advertisement, with Pinduoduo as the advertiser.

In terms of operating metrics, as of H1 2023, Kuaishou has a DAU (Daily Active Users) of 366 million, with an average daily time spent per DAU exceeding 130 minutes.

Regarding financial metrics, advertising is the main source (contributing approximately 50% of the revenue), followed by live streaming and e-commerce, which contribute around 40% and 10% of the revenue, respectively.

What it's like to work at tech industry in China

I will share from four aspects: geographical location, working environment, my experience, and a typical day as a product manager.

Starting with the geographical location. The role of geography in history is often underestimated.

The headquarters of Kuaishou is situated in Xierqi, Beijing, just a stone's throw away from other technology enterprises such as Baidu, Tencent, and NetEase. Another name for this area is Zhongguancun Software Park ("Z Park"), which serves as a hub for technology companies. One can easily walk from one end to the other in just a few minutes. Face-to-face communication and talent flow are highly facilitated in this area. For example, it’s faily easy for me to grab a coffee with another friend from Tencent and have a chat during lunch time.

If we zoom out on the map a bit, the red box represents the location of the technology companies I just mentioned, while the green box represents the area where Beijing's top universities are situated. Prestigious universities such as Peking University, Tsinghua University, and Renmin University, which are among the best universities in Beijing and even in China, are located in this area (Bytedance is also headquartered in this area). This indirectly explains why the average age of Kuaishou employees is only 28 years old. It is convenient for university students to intern at these companies, gain an understanding of the work and environment, and then receive a return offer or secure a job through full-time recruitment. Generally speaking, campus recruitment accounts for a higher proportion of hiring in internet companies compared to other industries. At Kuaishou, it is not uncommon to see individuals under the age of 30 leading teams of over 100 members.

Moving into work environment, the video below provides an introduction to Kuaishou's new office area (I set the video at double speed to save your time). You can see that it offers various facilities such as cafeteria, barber shop, gym, post office, and clinic, providing everything one might need. People who work here view it as a campus.

The two points mentioned above also explain why the technology and internet industry attracts talent, especially fresh graduates.

Regarding working experience, my biggest takeaway is the cultural emphasis on being data-driven and user-driven. I will provide examples from my own experience to further illustrate this:

Data-driven: Decision-making is not based on subjective judgments but rather driven by data. In the case of several new products I have been involved with, decisions regarding resource allocation or whether we want to fully scale the product after the beta phase are not made solely by the product owner. Instead, we heavily rely on data feedback from the beta launch, such as user retention and user engagement metrics. These also provide a starting point for further user research and reflection on previous version of product design. Kuaishou has a data analysis team of over a thousand members to support every product and business within the ecosystem.

User-driven: As a product manager at Kuaishou, you have the full support of a professional user research team, many of whom come from backgrounds in professional user research firms like Nielsen. For key products, user research is often conducted on a weekly or bi-weekly basis. As an example from my experience with an internationalization product - before launch, the product's official name was not decided by the product manager and the team, but rather by providing initial users with a shortlist and allowing them to vote for the final name, which turned out to be easy to pronounce for users in different languages and accents (this is crucial!) and had no negative connotations in local cultures (this is often overlooked especially when you plan to enter mutiple countries in a short period of time).

"A typical day for a product manager" is a question I often encounter. I don't want to make up an answer because the reality is that there is no typical day since the focus varies depending on the stage of the product project. For example, before a product is launched, there is a greater emphasis on market and user research, as well as product planning. During the product development process, project management becomes more prominent as you work with designers and developers to complete product features and drive the product towards launch. After the product is launched, more time is spent on data analysis because data starts flowing in. I will work more closely with the data analysis team, as well as growth, marketing, and operations teams for promotion and user operations. I typically divide the work of a product manager into two parts: input and output. Input includes user research, data analysis, studying competitors, and others, while output includes product planning, project development, operation and growth strategy.

Why Short Form Video becomes a success and works well for a large-scale user base

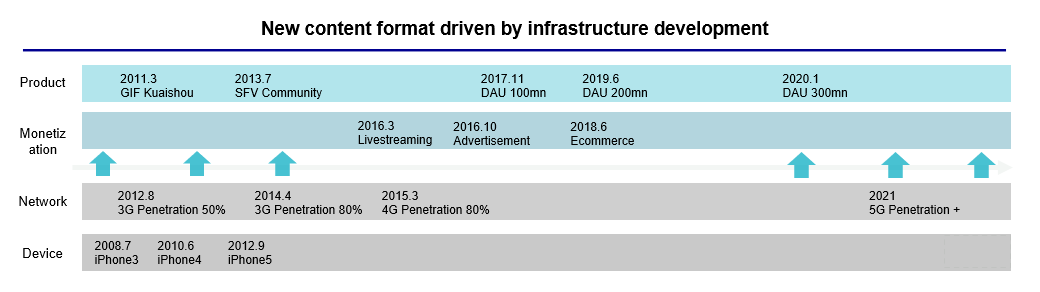

Douyin (the Chinese equivalent of TikTok) and Kuaishou have their own product innovations, which I will cover later. However, here I would like to share the often overlooked reasons for SFV's success and why SFV content has thrived from a broader perspective. Essentially, the development of infrastructure has provided a solid foundation for the flourishing of SFV content.

Taking Kuaishou as an example, it transformed into a SFV community in July 2013. In March 2016, it introduced its first live streaming feature and launched its advertising feature half a year later. Correspondingly, at the network level, China's 3G network penetration rate reached 80% in April 2014, and a year later, the 4G network reached 80%. The improvement in network infrastructure aligns with key milestones in product development. On the other hand, in terms of devices, the iPhone 3 was released in July 2008, followed by the iPhone 4 in June 2010 and the iPhone 5 in September 2012. Other smartphone manufacturers also successively released smartphones with touchscreens, laying the hardware foundation for the emergence of SFV.

Returning to the SFV ecosystem, it essentially functions as a two-sided network. On the supply side, there are countless content creators, while on the demand side, there are numerous content consumers. The beauty of a two-sided network effect lies in its continuous strengthening flywheel. Each new creator brings more value in content supply to the platform's consumers, while each new consumer provides more content feedback and commercial benefits to the platform's creators. Along this flywheel, the platform generates revenue for creators and itself through content-based advertising, live streaming, and e-commerce.

Douyin (the Chinese equivalent of TikTok) currently has nearly 800 million daily active users, while Kuaishou has nearly 400 million daily active users. This means that almost every Chinese individual's phone contains one or more short-video products. The average daily time spent per DAU exceeds 2 hours. As a product manager, from a more detailed product perspective, I believe there are four key factors that have made SFV a "product for everyone".

Low-cost creation tools ensure an abundant and diverse supply of content. The image on the left shows Kuaishou's content creation page, which you will find is not much different from the iPhone's camera interface. Additionally, it is accompanied by AI-recommended music to enhance the value of content consumption, and video templates that further lower the barrier to entry for content creation. The core of product design lies in keeping the cost of creation sufficiently low while producing valuable content for consumption.

Personalized algorithms: Personalized algorithms have permeated various products, and the underlying principle is that your usage footprint helps the algorithm better understand you and improve future recommendation efficiency and accuracy. However, personalized algorithms work exceptionally well for SFVs due to two reasons. Firstly, the feedback cycle is very short, which leads to a more agile recommendation system. Compared to videos on platforms like YouTube, SFVs receive more feedback from users within a fixed time period. Secondly, the feedback density is high, which privides more “fuel” for recommendation system. With the advent of touchscreen smartphones, you can easily like, collect, and share a video on the screen. Each action represents a different signal to the recommendation system, effectively helping it better understand its users.

Content-driven monetization: This phrase, coined by me, means making commercialized content more valuable for consumption. On average, for every 10 videos consumed, at least 1-2 of them contain commercialized content. However, most users are unaware of this when they open an SFV product. The underlying reason is that both advertisers and SFV platforms have the incentive to transform advertising content into "real content with consumption value". For advertisers, such content resonates with users and improves advertising efficiency. For platforms, this type of content enhances the user experience and minimizes harm to users. This is the direction towards which all short form video platforms have been striving in the past, at present, and will continue to do so in the future.

Lastly, but most importantly, I believe the widespread success of short-form videos is due to their alignment with human nature, which is a point that is underappreciated. This viewpoint is not my own creation but a discovery made during discussions with other product manager friends. For entertainment products, each user conducts a return on investment (ROI) analysis before and while using them. The return represents the benefits brought by using the product, while the investment represents the costs the user needs to put in. When the ROI of using a product is not high, users tend to choose to leave or uninstall the product. Regarding the success of SFVs, the key takeaway is that the majority of users are not concerned about the high return when consuming content products but rather require a very low investment. For example, from an investment perspective, when using an SFV platform, all you need to do is swipe, and even if you don't swipe, the next video will automatically play. You can just lie on the couch and no action is required. From a return perspective, consider a user spending more than 120 minutes on a short-video platform daily, where repeated or similar content is undoubtedly prevalent. As users spendmore and more time on the platform, the content gains per unit of time naturally decrease. However, this does not hinder the achievements of Douyin (TikTok equivalent in China) and Kuaishou as mentioned earlier. Correspondingly, in my conversations with friends in the game planning sector, we believe this is also the core reason why the audience for SFV is much larger than that of mobile games even though the former has a shorter history. Although mobile games (such as Freefire or PUBG) offer a higher experience return, the investment required from users (e.g, finger-based control, high level of focus, internet connection, etc.) is significantly higher compared to short-form videos.

In summary, infrastructure developments such as 3G/4G networks and touchscreen smartphones have laid the foundation for the emergence of SFV. Within the SFV ecosystem, the two-sided network serves as the core of the model. From a product design standpoint, the inclusion of low-cost creation tools, personalized algorithms, content-driven monetization, and alignment with human nature further enhance the flywheel and make SFV a "product for everyone".

Thanks for your reading and I hope you enjoy it. Stay safe and see you next time.